The Startup Game Is Rigged — Unless You Know What League You’re In

You thought you were ready for the big leagues. What if you’re not even in the right stadium?

The author of this post is Julien Petit

In the startup world, the word “startup” is thrown around carelessly, as if it simply meant “new company.” But let’s be real: when someone says they’re building a startup, they’re not saying, “I’ll grow my business organically.” What they’re actually saying is: “I plan to raise money.”

That’s the implicit definition today. If you call yourself a startup, you’ve already opted out of bootstrapping. You’re not playing the artisan game. You’re playing the VC game, even if you don’t know the rules.

And that’s the problem.

After more than 15 years in this ecosystem, thousands of hours speaking with top-tier VCs and thousands of hours spent coaching founders since 2016, I’ve come to one conclusion: most founders have no clue which game they’re playing. Worse, they don’t know which league they belong to.

Let me break it down. There are three leagues of founders in the startup world, and only one of them truly belongs in the VC arena.

The Fantasy League: The Dreamers

“Let’s raise millions and figure it out later.”

This is the largest group by far. First-time founders. Influenced by startup blogs, Twitter threads, recycled YC wisdom, and sometimes remnants of The Family’s storytelling. These founders build decks before building companies. They treat VC money like it’s a grant. No strings attached. Just fuel for a vague ambition to “try something new.”

They talk about MVPs, traction, lean startup. They think a prototype and a few users will get VCs lining up. Some even manage to raise small rounds from amateur angels, usually friends, family, LinkedIn cheerleaders, or well-off corporate execs curious about ‘getting into startups’. And they mistake that as validation.

But here’s what they never consider:

They’ve never considered the return expectations of real VCs, the kind of exit that turns a fund profit, not just a founder payday.

What does a VC need to return their fund and get beyond the 3X return?

What does it take to build a $1B company?

They’ve never done the math. They’ve never had anyone around to challenge their assumptions.

They’re not stupid. Just uninformed. No one taught them the real game.

The Midfield League: The Hopefuls

“We’re talking to VCs, so we must be on the right track.”

This league has a bit more traction. Maybe they’ve been approached by VCs. Maybe they’ve raised a solid pre-seed. They’ve got early momentum, some PR, maybe a first client or two.

And then comes the trap.

They think VC attention equals VC conviction. It doesn’t. VCs prospect constantly. They take meetings with hundreds of startups a year. Showing up in their inbox doesn’t mean you’re a top pick.

But most founders don’t know that.

They misread the signal. And worse, when challenged on ambition, they flinch.

Ask them: “Are you building a billion-dollar company?”

They’ll say: “Well, maybe. Ideally. But I’d be super happy with a $100M exit.”

And there it is: the misalignment.

Most VC firms, especially top-tier, aren’t looking for $100M outcomes. They need billion-dollar ones. Not as a nice-to-have. As a must. Unicorns aren’t bugs. They’re features.

So these founders are in limbo. They’re in the game… but not really playing to win. Their mindset, deck, and ambition don’t match the funding model they’re relying on. And by the time they realize it, it’s often too late to pivot their thinking.

Some stay in denial.

Some bow out gracefully.

But very few adjust in time.

The Champions League: The Contenders

“We know exactly what we’re playing for.”

This is the rarest league. Often repeat founders, or first-timers who’ve done their homework. They understand how the VC model works. They know the math. They know that raising capital comes with pressure and purpose.

They don’t just want to raise.

They want to return.

They aim for billion-dollar outcomes from Day One.

And because they aim that high, their story is sharper. Their insight is deeper. Their ambition forces them to reach for the kind of unique perspective that makes top VCs stop scrolling.

Benchmark, arguably the world’s most respected VC firm calls it “a thesis that makes you think.”

That’s the bar.

Not a polished deck.

Not a well-rehearsed pitch.

But a unique insight, the kind that reshapes how the VC sees the world.

And that kind of insight doesn’t emerge from nowhere.

It’s the product of an extraordinary ambition,

a relentless curiosity,

and an insane rate of learning.

Because real ambition forces depth.

Depth forces clarity.

Clarity enables alignment.

And alignment builds the kind of trust that unlocks term sheets from the best VCs on the planet.

Why This Matters

Most early-stage ecosystems, especially in France and Europe, are overrun with The Fantasy League and The Midfield League founders. Not because they’re not talented. But because no one ever told them the truth.

We sugarcoat. We inspire.

But we don’t educate.

We don’t frustrate.

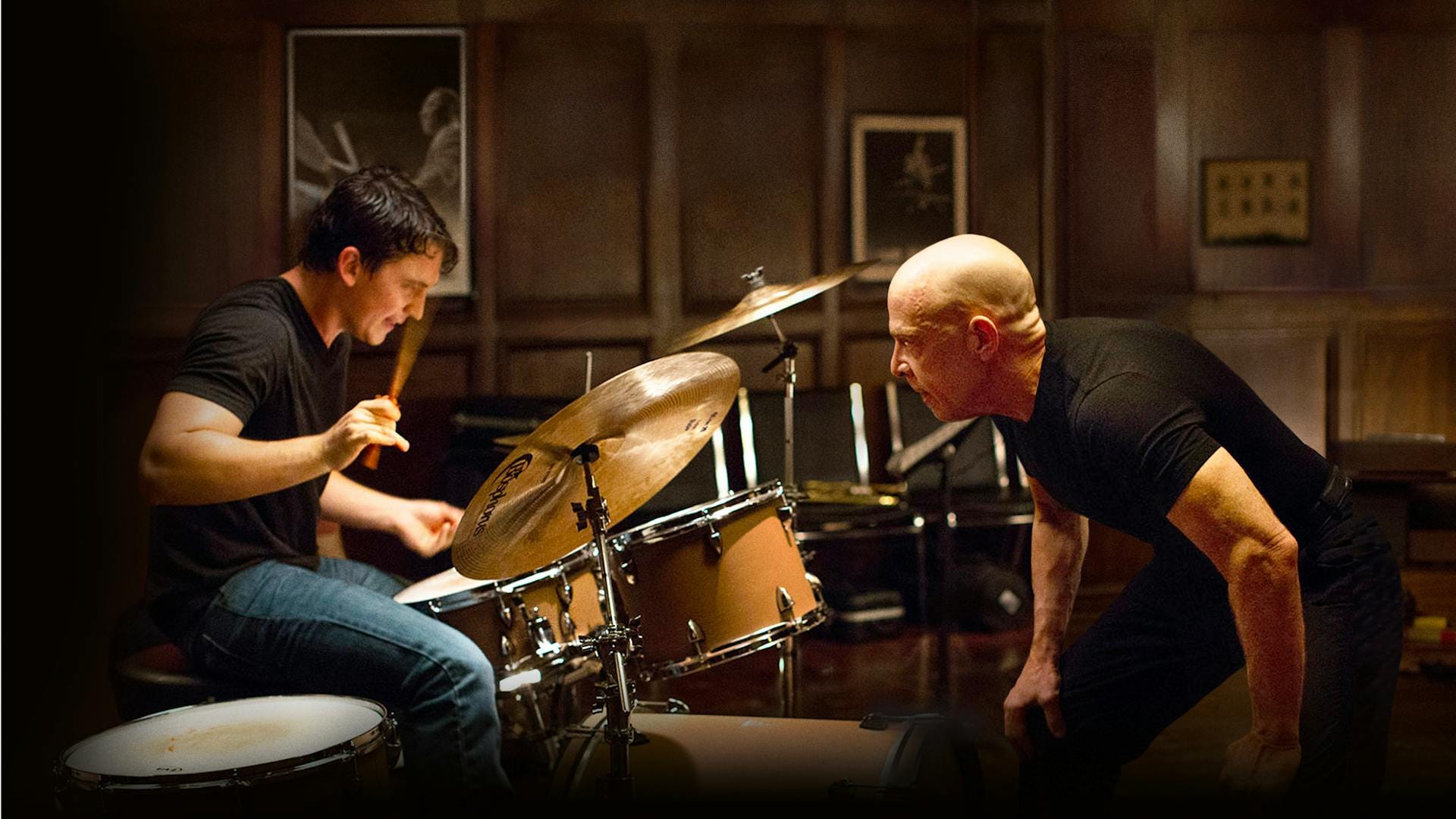

And without frustration, there’s no transformation, just like in elite sports, where daily discomfort is the price of real progress.

I’ve made it my mission to change that. I work like a prep-school coach meets investment banker. My role is to give entrepreneurs the truth, not just hope, which, frankly, is a terrible sales pitch in a world flooded with cheap inspiration, loud commentators, and founders-turned-gurus chasing attention. But I stick with it, because I believe it’s the only way that actually works.

Because if we want more global champions, we need more The Champions League founders.

And that starts by helping The Fantasy League founders stop wasting their time…

… and helping The Midfield League founders step up their game.

Want to dive deeper into the VC Game? I’ve got a whole framework for that. But for now, start by asking yourself:

What league are you in? And do you really want to play the VC game or are you just dreaming it?

The author of this post is Julien Petit

“Cutting Through The Noise” by Mighty Nine

Do you have a compelling story to influence the best VCs?

We are a VC fundraising investment bank.