The European VC Game Championship: Exits by Country 🇪🇺

Which VC-backed startups have achieved exits over $1 billion? Which European countries are leading the pack? And which VCs have reaped the rewards of these successes?

🇫🇷 Here is the French version of the article : LINK

The author is Julien Petit, founder of Mighty Nine.For the past few months, I’ve been asking everyone I speak with the same question:

“Over the last 20 years, which French VC-backed companies have achieved an exit of more than €1 billion?”

A simple question, yet no one has been able to answer it so far.

And now, as you’re reading these lines—do you know the answer?

Not so easy, is it?

👉 Here is the slideshow of the study👉 👉 Here is the list of exits by countryThe answer is Criteo, which went public on the Nasdaq in 2013 at a valuation of $1.7B, after raising only $60M in VC funding. Notably, Elaia and Eurazeo were among the fortunate early investors.

Then there’s Believe, which achieved an exit of over €1.9B on Euronext Paris. XAnge wrote the first €2M check, followed by Ventech with a €4M Series A. Subsequent Series B and C rounds brought the total funding to €166M.

Finally, Kyriba, founded in 2000, raised over $149M in total funding and welcomed IRIS as an investor in 2010. It was acquired by Bridgepoint for $1.2B in 2019.

To conclude, Deezer, founded in 2006, raised a staggering €364M (but delivered too low a return for such an amount—did the VCs actually perform?). Among its French VCs were Eurazeo and Crédit Mutuel Equity (CM-CIC). Unfortunately, the €1B exit was via a SPAC, and like all other SPACs in Europe, Deezer’s value plummeted immediately after its IPO, settling at just €155M.

The North Star of the VC Game: Exits Over $1 Billion

I’ve asked this question to more than 100 people, and not a single person could give me an accurate answer.

And I’m not talking about rookie entrepreneurs here. Among them were business angels, VCs, VC-backed founders, serial entrepreneurs, startup mentors, and various experts from the startup ecosystem.

I didn’t expect such a result, and it started to worry me. Why does no one seem to care about this question? How is it possible that we don’t instinctively ask it? Could it be that we’re missing a “North Star” to guide us in assessing whether our ecosystem is on the right track?

Financial performance is the cornerstone of the VC game. Early-stage money is invested into startups, with the hope of turning it into returns that can largely be reinvested into the system to fund new ventures. The number of VC-backed startup exits is like the score in a sports competition. By looking at this data, we can assess the economic health and competitiveness of our ecosystem.

The typical response I received was along the lines of: “That’s easy! Without thinking too hard, I’d say Doctolib! Payfit! Qonto!… There are tons of them!”. In 80% of cases, my interlocutors immediately thought of French unicorns. But when I clarified that I was asking about “exits” rather than the valuation at the last funding round, there was often silence, a moment of realization, and, for some, an uncomfortable sense of cognitive dissonance.

To wrap up the discussion, I would ask one final question:

“In your opinion, does a young talent with the potential to become the next Mbappé know by heart which teams won the FIFA World Cup over the last 20 years?”

Every time, the answer was unanimous: to perform, you need to know who the past champions were. Without knowing the classics, it’s impossible to raise the bar and rise to the challenge.

I then realized that the issues within our startup ecosystem run deeper than I had initially thought. The narrative we’ve embraced—focusing exclusively on unicorns and endlessly talking about innovation—has distracted us from the real priority: financial performance. This innovation-driven storyline has lulled us into a false sense of security, creating an optical illusion that could severely impact our entrepreneurial competitiveness on the global stage.

Isn’t it time we take a hard look in the mirror and step up our game to build a more competitive ecosystem?

Is the French Tech Ecosystem Truly Competitive?

Judging by media coverage and the near-daily spotlight on startups, it’s easy to believe that all is well in France. If everyone is talking about it, and thousands of startups are raising money, then surely the system must be working. We hear claims that French engineers are among the best in the world, that the top AI specialists are homegrown, and that we’ve produced dozens of unicorns and billionaire entrepreneurs, according to Challenges.

So, why even question the competitiveness of our startup ecosystem? Everything seems to be going just fine.

But when we take a European perspective and shift the focus of our analysis, it quickly becomes clear that the picture is less flattering.

First, it’s important to note that the narrative is the same across all European countries, particularly in the Nordics, the UK, and Germany. Media outlets everywhere are celebrating the apparent success of their entrepreneurial ecosystems. They, too, boast about creating numerous unicorns, their governments pour substantial funding into fostering innovation, and their iconic startup founders are heralded as future multimillionaires.

🤷♀️ So, France isn’t unique in having a seemingly dynamic ecosystem.

What becomes deeply concerning, however, is when we dig into the numbers and compare countries. The real measure of success isn’t the number of unicorns but the number of successful exits.

Is France competitive in this area? Do we have as many billion-dollar exits as our European neighbors?

Unfortunately, the French ecosystem ranks only 10th in terms of total exit value, with $5.8 billion.

It also ranks 5th in the number of exits, with just four.

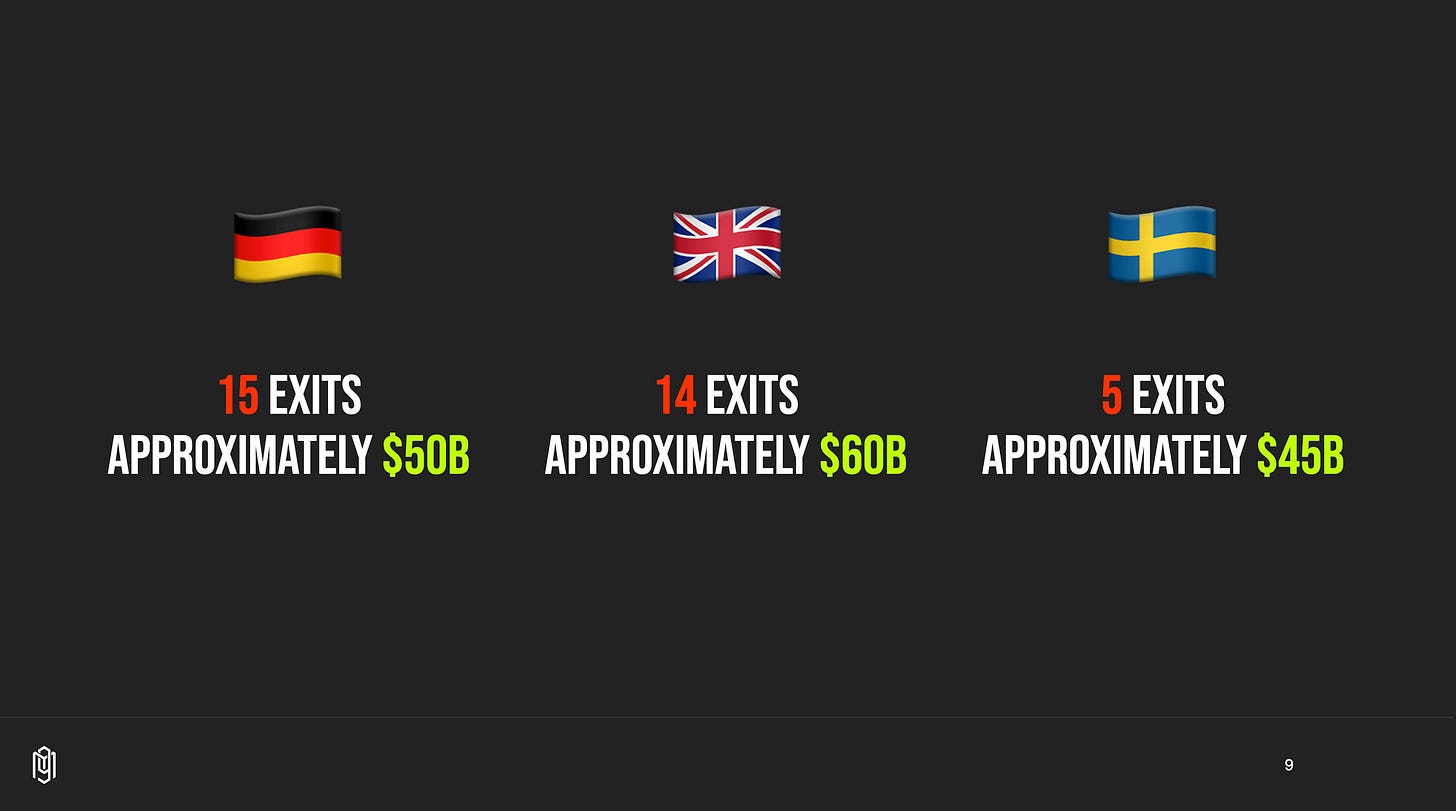

We are significantly outpaced by Germany, the UK, and Sweden, not only in total exit value, where France lags 10 times behind, but also in the number of exits. Germany and the UK outperform us by five times, with 15 exits each.

Who are the VCs that benefited from these successes?

#1 - Index Ventures 🇬🇧

Index Ventures is undoubtedly the VC fund that has had the most success. They invested early in 12 startups that achieved exits worth over $1 billion.

The list is extensive: Wise 🇬🇧, Deliveroo 🇬🇧, Funding Circle 🇬🇧, Deposit Solutions 🇩🇪, King.com 🇸🇪, iZettle 🇸🇪, Just Eat 🇩🇰, Adyen 🇳🇱, Elastic 🇳🇱, Farfetch 🇵🇹, Criteo 🇫🇷, and Skype 🇪🇪.

Accel is, of course, well-positioned, and it’s no surprise given that their team based in London has a strong presence across Europe. They have backed 6 startups that achieved significant exits: UIpath 🇷🇴, Supercell 🇫🇮, Deliveroo 🇬🇧, Flywire 🇪🇸, Letgo 🇪🇸, and ForgeRock 🇧🇻.

NB #1: Accel was also an investor in Spotify, but at the time of its Series B round of €100M, making them a “late-stage” investor.

#3 - HV Capital 🇩🇪

Based in Munich, HV Capital is the VC fund with the most exits over $1 billion in Germany. They had the opportunity to participate in the early rounds of 5 successful startups: Delivery Hero 🇩🇪, Zalando 🇩🇪, CityDeal 🇩🇪, HelloFresh 🇩🇪, and Depop 🇮🇹.

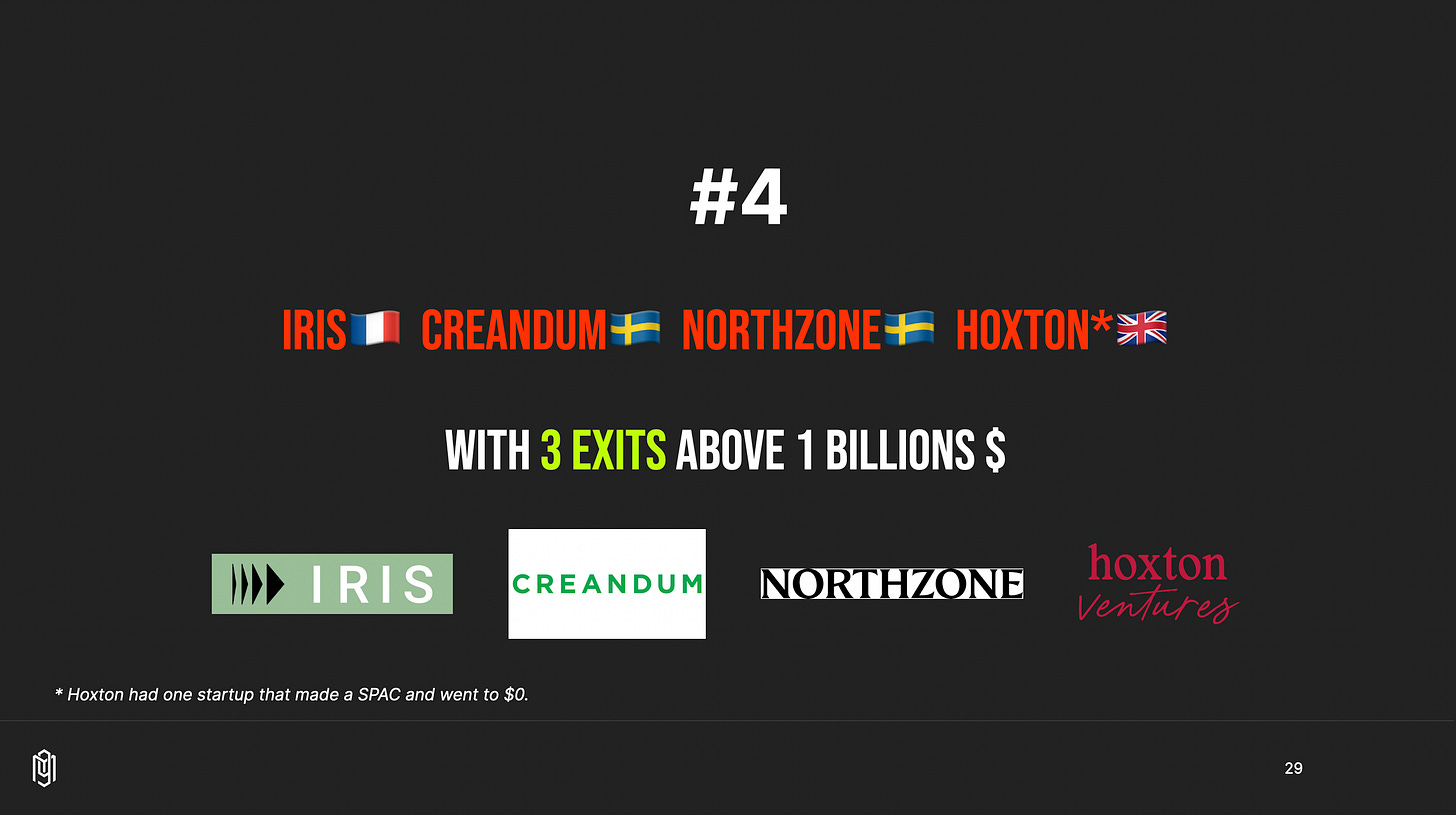

#4 - IRIS 🇫🇷, Creandum 🇸🇪, Northzone 🇸🇪, Hoxton 🇬🇧

These four VC funds each had 3 strong investments that resulted in impressive exits. Notably, the Franco-German fund IRIS is alongside some of Europe’s top venture players, particularly Creandum and Northzone.

IRIS 🇫🇷: LeanIX, Adjust, and Kyriba.

Creandum 🇸🇪: Spotify, iZettle, and Kahoot.

Northzone 🇸🇪: Spotify, Trustpilot, and Kahoot.

Hoxton 🇬🇧: Darktrace, Deliveroo, and Babylon Health.

French Funds

IRIS is not the only French fund to have backed startups that exited for over $1 billion:

XAnge is in a strong position, having cashed in €150M from Believe’s exit. (It’s also worth noting that XAnge exited its position in Odoo in 2021 during the large round led by Summit Partners, which valued the startup at $2.3B).

Ventech did the same, as they were also investors in Believe.

Elaia and Eurazeo were fortunate to invest early in Criteo.

Eurazeo et Crédit Mutuel Equity (CM-CIC) had Deezer, but the huge amount raised, and the SPAC didn’t bring enough performance to be satisfying for any VCs.

Why are these countries, other than France, so successful?

💂 I would say that all roads lead to London.

London was far more dynamic than France in its early days. It gained a head start, a significant lead.

🇪🇺 It wasn’t because of the government, nor tax incentives for business angels, nor even the City, but rather the European dynamics that were fully playing out in the UK, and particularly in London, the gravitational center of Europe’s tech and entrepreneurial movement.

In 2010, London was a city of 8 million people. For years, it had attracted millions of people from all over Europe, including the Baltics, Poland, and a significant number of Italians, Spaniards, Portuguese, and quite a few French. Everyone was looking for a job, as finding one was easy; pure economic immigration. Today, 34% of London’s population was born outside the UK. English became the only language uniting everyone.

At the same time, around 2010, in France, Loic and Géraldine Le Meur were organizing the major international conference Le Web. However, in London, the iconic Mike Butcher was also organizing GeeknRolla, which was smaller, less ambitious, but notably had a massive presence of entrepreneurs and investors from the Nordics, including Denmark, Sweden, Finland, and especially the Baltic countries. Le Web was sold in 2012 and lost its momentum, while GeeknRolla faded away, making room for the Web Summit, which left a significant European imprint (Dublin and Lisbon).

In fact, the VCs who made the best investments are based in London: Index Ventures and Accel.

The case of Wise is emblematic, as it was a company created by a 100% Estonian team 🇪🇪 (Kristo Käärmann & Taavet Hinrikus), who launched their venture from London from the very beginning. It’s not the only startup that benefited from London’s ecosystem—Depop 🇮🇹 and Farfetch 🇵🇹 started their journeys in their home countries but quickly moved to London to accelerate their ambitions.

How can we fix this and make France a competitive country?

The solution is quite simple: speak English 🗣

We all need to switch to communicating in English consistently. We should not be ashamed of our French accent. We need to be more disciplined in using English as the language to share our knowledge.

🚂 We also need to travel more, regularly spending time with our European cousins. Spend time in Amsterdam, London, Berlin, Milan, Madrid, Barcelona, Stockholm, Copenhagen, Tallinn, Dublin…

💸 No need to inject more capital into the system; there’s already enough.

🪖 No need to flood the airwaves with French Tech messages or to fuel ego wars between regions and against Parisian hegemony.

If you want access to the study’s database, send me an email at: julien@mighty9.co

This study would never have been possible without Dealroom, an essential tool for preparing your investor roadshow and familiarizing yourself with the VC game.

The author is Julien Petit, founder of Mighty Nine.Cutting Through the Noise

Do you have a compelling story to influence the best VCs?

We are a VC fundraising investment bank.

This is the classic debate: should ambitious entrepreneurs launch directly in the U.S., knowing that the competition is fierce? It’s a market where success isn’t guaranteed, and in fact, the odds might be stacked against you.

There’s also the cultural barrier, entering a new country and expecting to dominate the market from day one rarely works. It often requires years of adaptation.

The debate between starting in the U.S. or Europe is complex, and everyone has valid opinions. If you’re building a pure B2B software company and have bold ambitions, heading to the U.S. is tempting. But for other types of ventures, why not focus on Europe and aim to conquer this market first?

What’s certain is that focusing solely on France won’t lead to a truly ambitious company, let alone a VC-backed one. Cracking Europe, however, is another story. To me, the key is embracing a nomadic approach: spending time in each country, learning their nuances, and building connections.

The biggest challenge we face is comfort. Too many entrepreneurs stay in their cities, in their comfort zones. Ambition and comfort simply don’t mix.

I loved the country / exits graph!